Tax Day is Coming: How to File an Extension

|

|

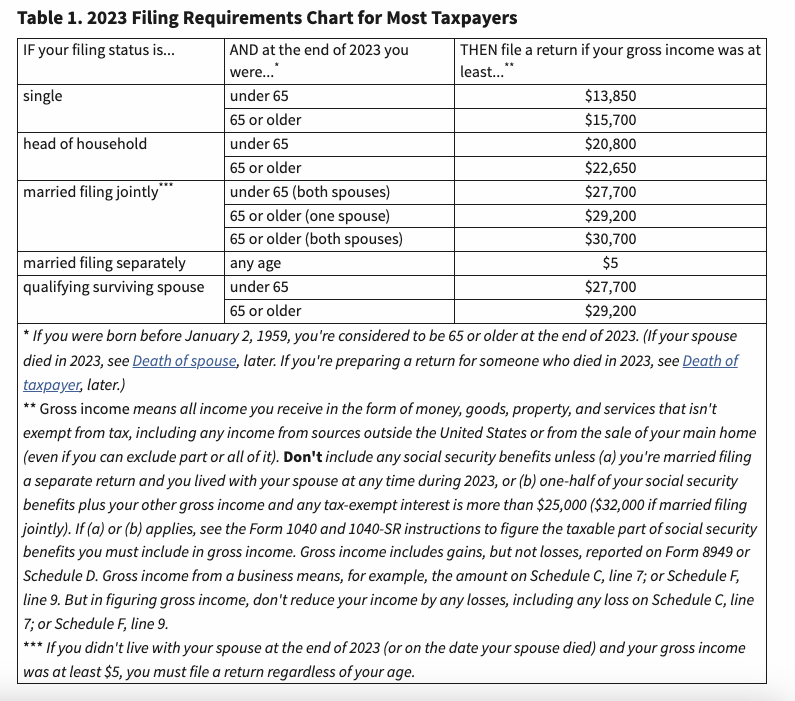

Tax Day is Monday April 15th this year. If you are a U.S. citizen or resident alien, whether you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent. If you must file a tax return, these are due by midnight on Monday. The IRS website provides a chart that helps one determine whether one must file a tax return or not. We provide a copy of this chart to share with others.

In some cases single and married dependents must also file income tax reports. These filing requirements for dependents are discussed in more detail on the IRS website.

How to File an Extension

If one needs an extension they may file form 4868, which we have available for download to share. This form is due by the tax deadline, and provides information about where to submit the form upon completion.

A U.S. citizen or resident files this form to request an automatic extension of time to file a U.S. individual income tax return. In the State of Ohio, a federal extension automatically extends the due date for the separate tax filings that the State of Ohio requires as well.

In a separate article we shared information about how to get FREE assistance filing tax returns at Tax Prep sites operated by the United Way. At each of these Tax Prep sites, trained, IRS-certified volunteers ensure that eligible taxpayers receive credits such as the Earned Income Tax Credit and the Child Tax Credit, which play an important role in reducing poverty.

You can find more resources related to Citizenship by selecting the “IDs & Citizenship” tab on our “Social Service Utilization Library” page.